tv Street Signs CNBC April 23, 2024 4:00am-5:00am EDT

4:00 am

♪ good morning. welcome to "street signs." i'm frank holland with silvia amaro and these are your headlines. the ftse 100 hits a fresh record high. stateside, the ceo of the sovereign wealth fund warns against optimism. >> there is a lot of froth within the technology sector. whether it is too much or not, it is unclear. we will get results coming

4:01 am

through with pockets of fear. s.a.p. shares bounce. the ceo outlines how integral artificial intelligence now is to that business. >> we are embedding a.i. until the center of the business models of our customers to deliver immediate results. our customers are paying for what they are using. our model is flexible. swiss pharma giant novartis boosts its guidance with the net revenue jumping 10% in the first quarter. our u.s. colleagues will speak to the ceo later on today. and renault confirms the full-year guidance after revenue jumps 6% in the first quarter at 11.6 billion euro.

4:02 am

good morning. we start the show today with breaking news when it comes to pmi data from the eurozone. let me share the latest numbers with you. when it comes to the composite flash figure, it came in at 51.4. that is above what markets were expecting at 50.7. it is also an upgrade from the march figure. the overall composite number is coming in higher than what analysts were expecting. when it comes to the breakdown between services and manufacturing, let's start with services. it came in at 52.9. that is also higher not just in terms of how analysts were expecting, but also in terms of the figure we received for the month of march. when it comes to manufacturing, there has been a lot of conversations about the slowdown in the manufacturing side of the

4:03 am

economy. the flash pmi for this part of the sector came in at 45.6 which was actually slower than what analysts were expecting at 46.6 and a slight downward move compared to what we had seen in march at 46.1. all in all, to sum up the numbers, we are seeing an improvement when it comes to the overall figure for flash pmi in the eurozone. we are seeing a lot of strength with services, however, the manufacturing part of the economy still seems to be struggling. we're going to have questions here about what is actually happening when we might see a turn around when it comes to the performance in manufacturing. in order to discuss these latest figures in detail, i'm pleased to say chris williamson at snp

4:04 am

global markets is with us. first off, my first question is regarding manufacturing. we are seeing an improvement with services. why is manufacturing still struggling? >> good morning. the main reason is germany being the key area of weakness in the eurozone. germany is still struggle with i adjustments after the invasion of ukraine and the manufacturing took a hit t. nee. it needs to adjust to a different energy . it is going through a period of adjustment. there is few signs of it lifting higher. it is disappointing to see the order book situation. it looks like the manufacturing sector is stuck in the period of

4:05 am

malaise. there are better signs outside of germany in the periphery outside of france and germany where the manufacturing sector is showing signs of stabilizing which is welcome news. that's been the case for a few months now. it is failing to get that liftoff. >> i like your thoughts on price pressure. last month, you said they were elevated in services and in manufacturing. what is the data telling you at this stage about price pressures across eurozone? >> across the whole goods and services, there is an increase of inflation pressure in april. these are modest compared to a year ago. when you compare the pmi data against cpi, for example, there is a good correlation that it leads pci. it is fairly comfortable in line

4:06 am

with the ecb expectations. we should see the wage driven increases start to come out of the equation. as you get headline inflation numbers come down, the bargaining power starts to moderate. we still have the service sector wage inflation pressure keeping the overall price gauges elevated by historical standards. they are above the pre-pandemic level. you are still helping bring inflation down. it is the sticky services and that is key to the wage power which starts to moderate through the year >> chris, the numbers just crossed. stronger than the forecast in expansion territory. i want to come to this report.

4:07 am

orders to inventory ratio was the highest in two years. you noted the inventories are working faster than the orders. is that a bullish sign for the economies and with the shift on just in time inconveniinventory? you look to those to accelerate in coming months? >> it should help. we saw a host of ratios and future expectations all start to lift higher. they remain elevated. we're in a better position than six months or a year ago in the manufacturing sector. germany still seems to be struggling. it seems it is the energy hit that's causing that drag. as i stated, outside of germany, there are more encouraging signs now. you have the stabilization element. it looks like italy and spain are now starting to see manufacturing revival that will help the overall industrial picture in the eurozone.

4:08 am

that is bringing some pricing power through to manufacturing in those countries as well which will add to the inflation picture. it is fairly modest at the moment. we do need to watch out for the energy and fuel price increases coming through to manufacturing and driving more price pressure. as we stated last month, there is a sign of that cycle starting to be more positive for europe and globally. >> you talk about the inventory cycle being more positive. how do commodities play a part in this? we see the rise in the price of commodities and at the same time, we have seen oil ease back a bit from the eyes of earlier this year. how are those two things balancing out when it comes to specifically manufacturing? i know they don't impact services as much. >> for the eurozone, there is a plentiful supply situation. that's gauged by the supplies.

4:09 am

there are few supply constraints. the red sea issues were very much a concern in january where we saw delivery times lengthened. since, delivery times have improved. from the commodities side and input cost side, you are seeing a good availability scenario at the moment to keep prices down. that demand situation is starting to pick up. that inventory cycle is picking up a bit and that is leading to price pressures on commodities more broadly. that should be a thing we see continue to play out in the next six months. this is above and beyond what we are seeing from the tech side. the technology drive commodity related price rises. this is more broad based. basic materials. if you look at global pmi data to march for things like basic resources so the real raw

4:10 am

materials that go into making metals and so forth, that demand is starting to pull around. we will see that as we go through the year. >> chris williamson at s&p global markets, thank you. let's look at the equities which have been trading for over an hour. we are reviewing the pmi figures from the eurozone. this is what we are looking at with equity performance. we have the stoxx 600 currently moving higher by .5%. the index had ended monday's session up 0.6%. what we're seeing today is investors seem to be more focused on the earnings season as well as on what's happening when it comes to the data releases. with that in mind, i want to take you to the geographic

4:11 am

divide across europe. they are all trade in the green this morning. theftse 100 in the uk is up .40%. it has crossed over that 8,000 mark and one of the reasons behind this is we have seen a weaker sterling. that is driving the momentum with the uk equities. on top of that, recent sentiment over certain defense parts of the market such as shell and astrazeneca has boosted the momentum. we we see pockets of green in france and germany. i would highlight what you are seeing today is related with the earnings season. we heard from the likes of s.a.p. and ab oods. with that, let's take you to the corporate news with the sectors in europe. we have at the top is the tech

4:12 am

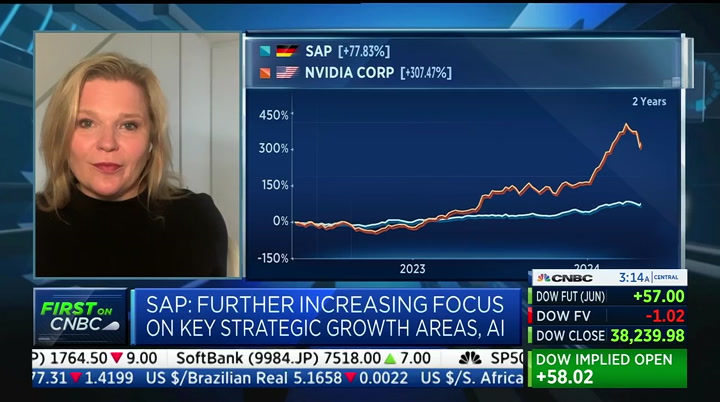

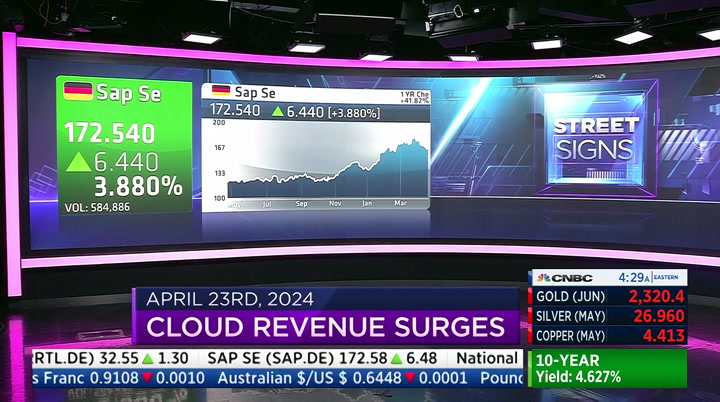

sector up 1.6%. a lot of focus overall with the tech space. we will hear from the big tech companies stateside like microsoft and tesla. we are seeing pockets of green when it comes to tech in europe. it is driven by the results we are getting from the tech space in europe. retail is up 1.3% as i mentioned earlier with the result from ab foods which is contributing to the positive momentum. they beat on the expectations. when it comes to the worst performing ectors, it is basic resources down 1.2%, frank. >> you mentioned technology is out performing. one company is helping is s.a.p. it is reporting first quarter cloud revenue in line at 3.9 billion euro which was a 24% increase from the year earlier as the surge for artificial intelligence is fueling growth.

4:13 am

annette is joining us with more. shares are moving higher, annette. >> reporter: yes. we have seen positive momentum more s.a.p. shares for a couple of months. this is pushing them higher again because clearly they are reconfirming outlook for the year and the partnership that nvidia seems to be working quite well. in a nutshell, what they are saying is they have loads of data and they have most data among tech companies and together with nvidia, they can connect the dots and offer a.i.-related products to customers. that's how they want to out performance compete with the likes of oracle and salesforce which are the two biggest competitors. oracle is big in the enterprise with resource planning and

4:14 am

salesforce is dominant in the customer relationship management where s.a.p. wants to grow as well. as i said, a.i. is the future here and cloud-based revenue because it is all subscription models which is more lucrative than license revenue. perhaps, we listen to what christian klein said about the relationship with nvidia and the partnership and how they want to develop that further. >> i can remember when we met a year ago and we actually talked about how great the partnership is between our companies because nvidia has the hardware and platform to deliver quality a.i. we have the business data. no other tech company has more business data than s.a.p. bringing those two assets together will deliver powerful a.i. use cases for our customers

4:15 am

in software development and seseep sales. when you consider millions of end users are doing transactions with s.a.p. every day, you can imagine how powerful copilot will be. >> reporter: i had a look at one of the business cases at the company headquarters. you can navigate through supply chain issues more quickly if you apply an a.i.-based customer solution tool which is one of the use cases. it is impressive what you can do if you combine the data with working a.i. solutions. having said that, the company is also going through a huge restructuring effort. they are shedding 8,000 jobs. that's why they have a loss this quarter. the charges are higher than

4:16 am

previously anticipated because of higher redundancy costs in the united states where more people opt for reearly retireme packages. on the one side, business is well and on the other side is with the loss with the restructuring to be a.i. ready for the future. >> thank you very much for that report. turning our tension to akzonobel with the 19% rise in the first quarter profit. it saw organic sales rise by 2% driven by higher volumes by paints and coatings. novartis had a beat in the first quarter. it increased 11% with earnings per share came in at $1.80. shares are up 4.5%. our u.s. colleagues will speak to the novartis ceo this

4:17 am

morning. ab foods hiked the profit outlook and raised dividend to 20 pence in the first half operating profit with revenue at 9.7 pountds. coming up on the show, let's get to steve who is at the world energy congress in rotter dam. >> reporter: thank you very much. we have a dose of reality after the break t. is all very well with the leaders talking about energy transition and the energy dilemma. if you don't put it in context with higher interest rates and inflation and wars, you name it, it doesn't mean a lot to voters and viewers. i'll put it in context after a short break. switch to shopify and sell smarter at every stage of your business. take full control of your brand with your own custom store. scale faster with tools that let you manage every

4:18 am

sale from every channel. and sell more with the best converting checkout on the planet. a lot more. take your business to the next stage when you switch to shopify. what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com.

4:19 am

shipstation saves us so much time it makes it really easy and seamless pick an order print everything you need slap the label on ito the box and it's ready to go our cost for shipping, were cut in half just like that go to shipstation/tv and get 2 months free business. it's not a nine-to-five just like proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer.

4:20 am

and check in. they all choose the advanced network solutions and round the clock partnership from comcast business. see why comcast business powers more small businesses than anyone else. get started for $49.99 a month plus ask how to get up to an $800 prepaid card. don't wait- call today. welcome back to the show. let's look at oil prices. they are heading higher so far this morning with brent up by 1% at the $87 a barrel mark. wti is moving higher by 1%.

4:21 am

this as investors continue to an investigation the risks from the middle east including sanctions on iran. that is as ministers and others gather in rotterdam for the world energy congress where steve sedgwick is joining us. steve, what do you hear from expert s at this stage? >> reporter: this is an industry struggling with the identity. the transition is faltering. it it is a rocky road. you just want to be oil and gas companies and others wants to transition quicker and others pragmatic in between. the fact of the matter is transition is struggling and confused. you have a lot of activists saying we have to move quickly regardless of the reality. that is not washing with viewers

4:22 am

and investors and some saying it is not cost effective especially in the era of higher interest rates and inflation and immigration concerns which is big for voters as well as transition. there has been a lot of copy about how actually the transition needs to take its place among other crises in the world. the activists would say it should be number one. that may have every right in saying that as well. i talked to angela wilkwilkinso about the transition. >> there is nothing wrong with the framework. i think we energy leaders have done a rubbish job in literacy. it has been about substituting supply without transforming demand. you can't transform demand if you are not using energy.

4:23 am

if we are serious about orderly inclusive transitions, we have to ask where is demand coming? demand is rising from the developing economies to come. a lot of people are talking about the transition from the place of comfort and convenience. is that really what energy transition is about? if it is about that, how do we have more people for planet? we need to use that. >> reporter: i have been messaging with christian from jpmorgan chase. he put out a piece saying a reality check is needed. it will take longer than everyone is going on about. between 2024 and 2030, we will require $3 trillion, 0.5% global gdp just on wind and solar. that is one figure for one part of the transition. the scale is enormous. countries are doing this with terrible back drops.

4:24 am

not everyone can do it from the living room. lebanon is doing this. they have war on the door step. i spoke to the lebanese energy minister to talk about the transfer of energy as the devastating war in the middle east is ongoing. >> lebanon is playing its part in the energy transition in the move toward a better future for its people and for the planet. at the same time, it is an overarching message any one of us in our part of the world has to bring forward which is to call for an immediate return to peace and immediate stopping of the hostilities and honoring of international solutions such as the u.n. solution for israel to honor a cease-fire and stop the unnecessary killing of the

4:25 am

thousands of people that we are seeing today. that is always a message that i like to bring and at the same time, this is about energy. energy is clearly dependent on stability. >> reporter: can you imagine trying to have an energy transition with hezbollah within your country and israel on your door step? it is not easy. the international energy companies just balk and say we want to invest with massive gas offshore, but it is too volatile. back to you. >> steve, thank you very much. steve is live in rotterdam. oil prices are rising right now. coming up here on the show, tesla shareholders are bracing for what could be the worst set of earnings in seven years. we will find out why coming up next. stay with us. ah, these bills are crazy. she

4:26 am

has no idea she's sitting on a goldmine. well she doesn't know that if she owns a life insurance policy of $100,000 or more she can sell all or part of it to coventry for cash. even a term policy. even a term policy? even a term policy! find out if you're sitting on a goldmine. call coventry direct today at the number on your screen, or visit coventrydirect.com.

4:27 am

what is cirkul? cirkul is the fuel you need to take flight. cirkul is the energy that gets you to the next level. cirkul is what you hope for when life tosses lemons your way. cirkul, available at walmart and drinkcirkul.com. my name is ashley cortez and i'm the founder of the stay beautiful foundation

4:28 am

when i started in 2016 i would go to the post office and literally fill out each person's name on a label and now with shipstation we are shipping 500 beauty boxes a month it takes less than 5 minutes for me to get all of my labels and get beauty in the hands of women who are battling cancer so much quicker shipstation the #1 choice of online sellers go to shipstation.com/tv and get 2 months free welcome back to "street signs." i'm silvia amaro with frank

4:29 am

holland and these are your headlines. european stocks gain after the up beat pmi print. the c,eo of the largest soverein wealth fund is surprised. >> we are expecting fewer rate cuts than the market did earlier in the year. i have to say my surprise is that the market has really taken it so well. s.a.p. shares bounce after cloud revenue surges in the first quarter. christian klein outlines how integral artificial intelligence is for the business. >> we are betting a.i. in the center of the business models of the customers to deliver immediate results. our customers are paying for what they are using. our commercial model is flexible and transparent. swiss pharma giant knovarti

4:30 am

revenue is jumping in the first quarter. renault confirms first quarter guidance, but tesla is expected to deliver the worst earnings in seven years when it reports later today. welcome back. we are seeing uk pmi coming in at 54 which beats the estimate of 52.6. 54 is a sign of composite in expansion territory. looking at flash manufacturing

4:31 am

at 48.7 which was below the estimate of 50.4. the estimate at 50.4. services is the driver for the uk uk economy above the estimate of 53. similar to what we saw in the eurozone which was expansion. however, it was led by services with manufacturing in contraction territory. flash composite above the estimate of 52.6. manufacturing in contraction at 48.7 which is below the estimate of 50.4. services continues to be the driver at 54.9 which beats the estimate of 53. a surprise to the upside with services. > >> just as a reference point for viewers, i looked at the potential rate cuts from the bank of england, frank. they are pricing in a 75% chance of seeing the first cut in the

4:32 am

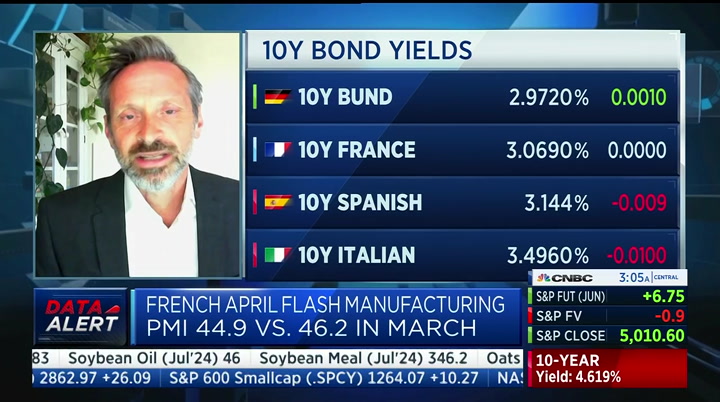

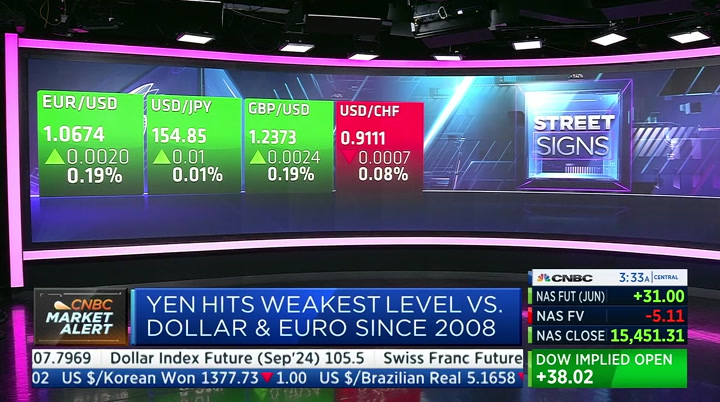

month of august. let's see how the data will continue to pan out. with the latest data in mind, i want to take you to the equity markets in europe. we are seeing the major boards trading in the green. we have seen the ftse 100 crossing above the 8,000 mark hitting the fresh record high. it is up by about .30%. we have seen a lower sterling and weaker sterling and investors piling in on the market which contributed to the momentum with the uk equities. we are seeing more significant moves to the upside over in spain with the main market up 1.1%. we are seeing the euro moving up .20% compared to the u.s. dollar at 1.06.

4:33 am

we know the u.s. dollar has been moving higher compared to the other currencies. that is actually changing today as we are seeing investors considering what might happen when it comes to ecb cuts as well. of course, we are keeping a close eye on the usd and the japanese yen. a lot of speculation that we are on the verge of seeing the japanese authorities intervening in the currency market. a lot of speculation if the benchmark hits 1.55 against the u.s. dollar. let's go to the bond market as well with the bond yields moving lower. the ten-year bund is moving higher at 2.5% flthreshold. we have seen that happening last week when we were back at that level. we have the yield on the t

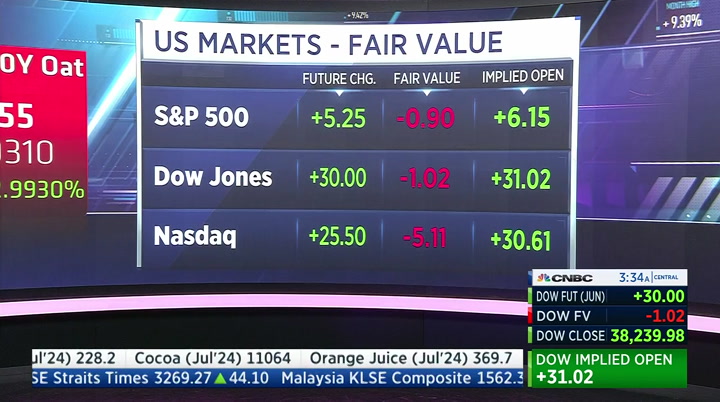

4:34 am

ten-year gilt moving higher at 4.2%. with the u.s. futures, this is how we are shaping up ahead of the open on wall street. the implied open suggests a slight positive start to the trading session stateside. this is important as we await to hear from several big companies including tesla today. we have a lot of important data coming from the united states this week, including pce figures and gdp data as well. when it comes to the corporate stories in europe, we are looking at renault. the company has reported first quarter revenue of 11.7 billion euro on the back of the stronger order book in europe. the french carmaker confirmed the full-year outlook. charlotte is joining us with more on the story. charlotte, what is the latest

4:35 am

from renault? >> silvia, the numbers were better than than expected. revenue up 6%. volume was up 2.6% as well with the cfo saying he expect the volume to increase in the second half of the year and stronger ev penetration as well in the second half of the year. they confirmed the target of 7.5%. you remember that is a cautious note from renault because they were lower than last year. this year will be tough for the ev maker with the chinese companies entering the market. it will be tougher. they are continuing with the stretch there pushing into the evs. this is going to lower the ev cost by 40% by 2027 and try to make the evs more affordable. they are launching more cheaper models. it will cost 25,000 euro and try to make this more affordable. you remember at the end of last

4:36 am

year, they canned the ipo of the ev unit. they have enough funds to do all of the changes in that part. they sold part of the stake of nissan to give them extra firepower with investment for renault. the numbers are better than expected. shares are bit in the green and in the red ahead of the tesla numbers that come out later today. the performance is up 40% in the last 12 months. >> charlotte, thank you. turning attention to tesla. th hitting the lowest level since january of last year. this stock is down 40% for the year and tesla losing more than $300 billion of market cap since the end of 2023. this ahead of what the wall street expects to be a dismal

4:37 am

first quarter. net income is seen down on the year, but expected to sink 40%. you see it right there in the middle. that is on the back of what lseg estimates the first revenue decline since the onset of the pandemic. a 5% revenue decline right there. it is a bit of a bad week for tesla after the 10% of employees would lose their jobs worldwide. markdowns in china risk wiping out the operating profit in the country. elon musk canceled a trip to india and said good-bye to two senior executives while the firm recalled every cyber truck it shipped so far. all this after the first fall in delivers in four years. you see it right here in blue. the fall from the previous quarter comes as the company's board asked shareholders to vote on the $56 billion pay package for elon musk which the delaware

4:38 am

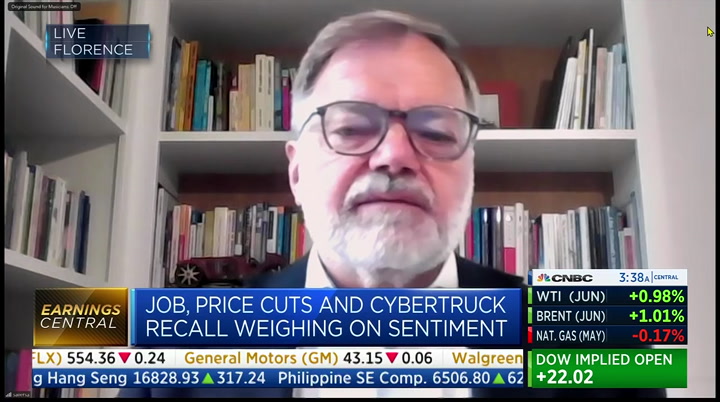

court voided in january. joining us now is the global vice chair at alix partners. what were you expecting from this this report and earnings call? >> there is no question it will be a fairly important quarter and month. i have to say elon musk has endured a tough moment with the delay of more than three plus issues. i think this is not necessarily the most difficult moment. there is no question that the market is looking at competition. i do think this is temporary. i think we are moving from the

4:39 am

market of early adopt afterers mass market. some of this was expected at least in our reports. >> evercore cited the price cuts will reduce any profit that tesla to make. is that just elon musk and tesla fighting fire with fire and competing against chinese makers not worried about profit or margin. is there a price cut boosting demand in the short-term, but it gets people in the tesla ecosystem? >> frank, as you say, there is $10,000 between the two cars. among the early adopters, the

4:40 am

purchasing power and with the range and salaries still present because the charging infrastructure is not keeping up. you have to do something to support. the government in some cases have delayed or reduced incentives. this is an important sign by tesla of support of the ev market. let us not forget that tesla has a higher margin than most comp competitors. ev is a lower margin. tesla has enjoyed a number of quarters. i had to say that price war will be initiated by tesla and that will be quickly followed by

4:41 am

ch china. we had the action in china which was following. in the u.s., the smaller market, is seeing less price. >> you are suggesting we will see a more intense price war with tesla and the chinese ev competitors. is this a race to the bottom? are we expecting prices to come down significantly amid the competitions? >> i don't think so. the issue historically has been hyper competitive and keeping the margins moderate for oems. what happened with the pandemic with the shortage of chips and shortage of supply is an upward

4:42 am

move for the market where you had to pay for a car if you wanted. i think this high margin period is coming to an end with the supply chain. i do expect the learning will stay. because the margin is smaller than i.c.e., they have to look not to lose profitability. finally, it requires significant investments in pbatteries and battery investment systems, but software. the next five years, the highest cost of the car, steel, plastic and everything else, to finance this development, you need cash. >> stefano, tesla stock has had

4:43 am

an impress suffive ride. there's a lot of noise when it comes to tesla. if you try to separate what is the fundamentals and all of the noise with tesla, do you find more positives or negatives about the stock? >> i think this is a very good question. i'm not particularly interested in the day-to-day. particularly on the company like tesla. let's not forget since the beginning of 2020. four years ago, it was 30 and now 140. it has been aroller coaster since the end of 2022. expectedly so with high growth. you should expect pounces in the road.

4:44 am

if you look at fundamentals, tesla has been early entry and enjoyed that advantage. it makes the mistake with the large model 3, but it is on the right trajectory even if it is a leaner trajectory. they are a better company now in the range of 400,000 for the quarter and still a basic significant one. there would be increase of stock this quarter. it will be interesting to see the cash and the cash burn. we will thknow that later today. there are new product issues

4:45 am

that are not reflected yet. >> thank you for your insight. a lot riding on the tesla report. six names in particular tend to benefit when tesla shares go into reverse. cnbc pro subscribers can find out on cnbc.com/pro. looking at apple, iphone sales fell 20% in the first quarter in china. the worse in the country since 2020. that's according to counter point research and comes despite the usual q1 lunar new year boost. the rival huawei saw sales climbing 70% in the same period. apple now ranks third in the country's market. investors are eyeing tech stocks as four of the magnificent seven are due to report earnings this week with tesla as we just mentioned,

4:46 am

kicking things off later today. >> it may be the mag six after this. >> we will see. we will see meta on wednesday and alphabet and microsoft set to release on thursday. speaking earlier to the channel, the norges bank ceo gave his view on the sector. >> if i look at what we can read from the current market, i would say there is clearly a lot of froth within the technology sector. we will get the answers later in the week. you have pockets of fear. you see a lot of reluctance to invest in china. it is an interesting time to apply this psychology. >> is there too much froth in the stocks at this point? what stage would you stick back and be aware of oversupply concerns in the semiconductor area? >> i don't have a strong feel

4:47 am

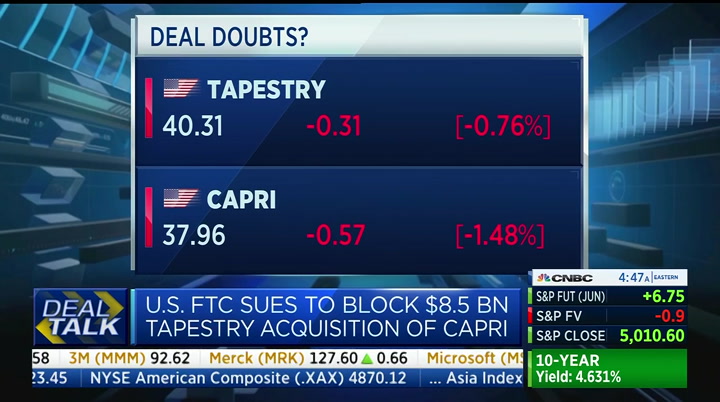

for whether nvidia is overvalued. it is an incredible company with amazing technology. in the lead when it comes to the chip sector. of course, theceo is doing just a tremendous job. whether it is overvalued or not, i haven't got a strong view. >> a lot riding when it comes to the big tech earnings reports. let's see what the companies have to say. elsewhere in the corporate world, u.s. ftc has sued to block tapestry's $8.5 billion acquisition of capri. it would hurt competition in the exce accessible handbag market. the ceo of tapestry said they mis misunderstand the market. coming up on the show, we will have the latest from the

4:49 am

it's hard to run a business on your own. make it easier on yourself. with shopify, you have everything you need to sell online and in person. you can have your inventory, payments, and customers in sync across all the places you sell. it doesn't have to be lonely at the top. join the millions to finding success on their own terms. start your journey with a free trial today. my name is teresa barber. i was in the united states navy and i served overseas in the middle east and africa. early on in my career i had a commander that taught our suicide prevention training on a friday afternoon and the very next day, he took his own life. 90 percent of suicide attempts involving a gun are fatal. you don't know how much somebody can hide what's going on in their head.

4:50 am

store your guns securely. help stop suicide. when i was your age, we never had anything like this. what? wifi? wifi that works all over the house, even the basement. the basement. so i can finally throw that party... and invite shannon barnes. dream do come true. xfinity gives you reliable wifi with wall-to-wall coverage on all your devices, even when everyone is online. maybe we'll even get married one day. i wonder what i will be doing? probably still living here with mom and dad. fast reliable speeds right where you need them. that's wall-to-wall wifi with xfinity.

4:51 am

welcome back to the show. ukraine is set to receive further long-range missiles from the uk in the aid package from the prime minister. the package includes additional 500 million pounds taking the uk support to kyiv to 3 billion pounds this fiscal year. the president of the european bank for reconstruction and development said despite delays, she still sees strong american support for ukraine. >> the very good news is the u.s. decision in congress to move forward with the package which was a really strong sign after all of the delays to get the package through. i think my take is that there is a strong commitment to continue to support the country with the military which is very important

4:52 am

and also the economic support for the budget of ukraine which is key for the program and it has contributed to the economic stabilization in the country and also supporting the economy. it is supporting the infrastructure and private sector and keeping business going. turning to u.s. news. prosecutorins accuse former president trump of trying to corrupt the 2016 election in the hush money trial in new york. trump denies having an affair with porn star stormy daniels. we have brie jackson with more from washington, d.c. with the latest on the case and the developments. brie, good morning. >> reporter: good morning, frank. testimony will continue today. on monday, prosecutors argued before he was president, he led a scheme to quiet stormy daniels

4:53 am

and corrupt the 2016 election. they called the first witness who is expected to be back on the stand today. the former president aired his grievances after the tense day in the courtroom on monday. he called the trial unfair and complained about being in court instead of on the campaign trail. he is facing allegations of hiding hush money payments made to stormy daniels and falsifying business records. he lied on business records over and over again. prosecutors say the allegations are backed up with a paper trail with bank records and text messages. the defense portrayed trump as a family man. mr. trump's attorney argued there was nothing wrong with trying to influence an election saying it is called democracy. prosecutors called their first witness, david pecker, they

4:54 am

allege he played a key role from women who claimed to have affairs with the former president. trump denied having a relationship with daniels and pleaded not guilty to the criminal charges. back to you. >> brie, the situation with stormy daniels is a point of contention in the trial. is trump denying any relationship with stormy daniels? it feels that was established they had some type of relationship. >> reporter: the former president has denieding having relations with daniels. this trial is expected to last four-to-six weeks. the former president contends he is willing to take the stand to defend himself in the matter. >> brie jackson, thank you. former president donald trump is set to earn 36 p

4:55 am

mill million additional shares in trump media. fifa is edging to a tv deal with apple to give the tech company the global rights for the version of the club world cup according to the new york times. the deal could be announced this month and valued at $1 billion. i do call it soccer. i wish ea and fifa would team up. >> you know, this story reminded me of netflix. push to live sports is a trend for all of the streaming giants. as we approach the end of the show, i want to look at the market action. at this stage, we are seeing the major boards trading in the green. we are paying attention to the ftse 100 after it reached the record high up by .30%.

4:56 am

that is boosted by a weaker currency. when it comes to the u.s. futures, this is what we are looking at ahead of the u.s. open. it is suggesting it will be a positive start to the session on wall street as well. of course, all eyes on the earnings season. we will hear from tesla, the big tech giants. we will also get very important data from the united states. we have pce this week and gdp. no doubt, a busy week. >> i want to ensure the audience, not only you made a face, but everybody in the gallery winced when i called it sock soccer. i'm frank holland. silvia amaro. "worldwide exchange" is coming up next.

4:58 am

when we started our business we were paying an arm and a leg for postage. i remember setting up shipstation. one or two clicks and everything was up and running. i was printing out labels and saving money. shipstation saves us so much time. it makes it really easy and seamless. pick an order, print everything you need, slap the label onto the box, and it's ready to go. our costs for shipping were cut in half. just like that. shipstation. the #1 choice of online sellers. go to shipstation.com/tv and get 2 months free. business. shipstation. the it's not a nine-to-five of online proposition. it's all day and into the night. it's all the things that keep this world turning. the go-tos that keep us going. the places we cheer.

4:59 am

5:00 am

it is 5:00 a.m. here at cnbc global headquarters and here is your "five@5." futures are working to keep momentum after snapping a losing streak. a wave of reporting today with tesla looking at the list of problems. u.p.s. reports with the shipping giant expected to report a profit decline. we will tee up the numbers to watch. >>

21 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11